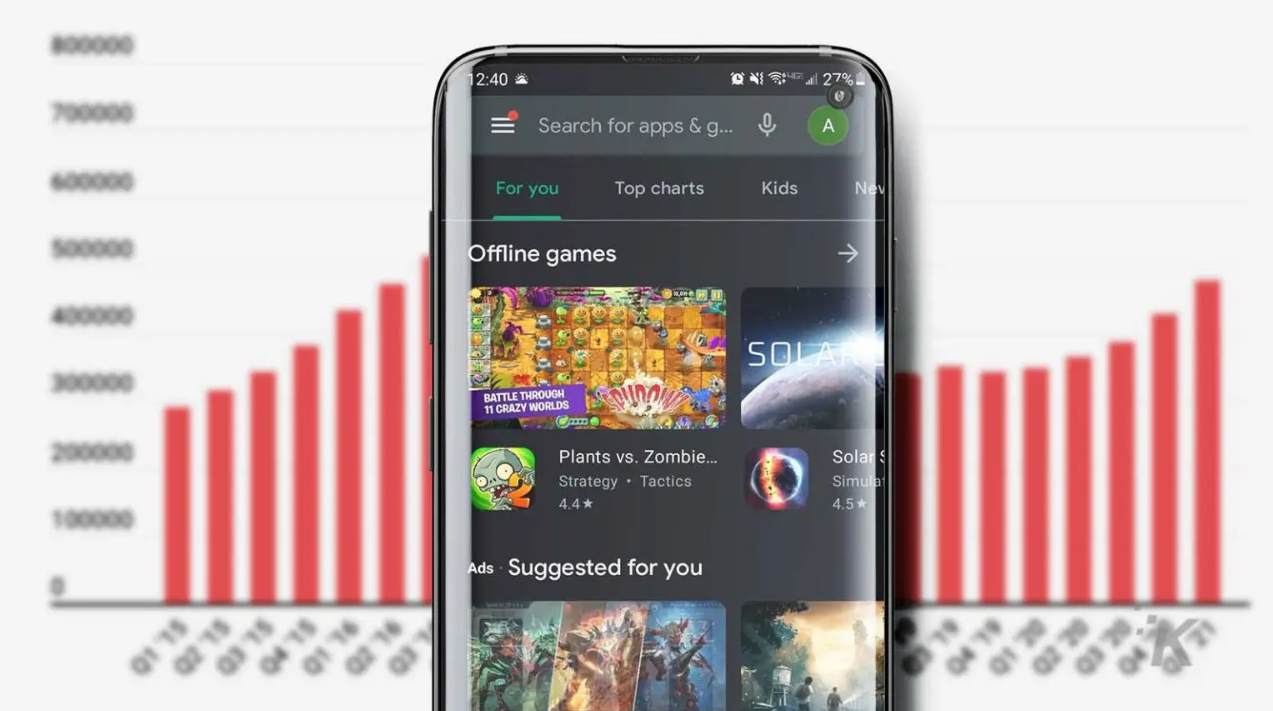

Mobile gaming has become incredibly popular, and it’s like that trend goes to continues. The Google Play store has just added the foremost games ever during a single quarter. quite 50,000 gaming apps were added to the Google Play store within the half-moon of 2021.

123scommesse has presented us with five years of knowledge showing just how popular mobile gaming is on the Google Play store. Since 2015, mobile gaming has seen incredible growth on the platform, peaking at over 675,000 gaming apps near the start of 2018.

2018 saw a mass cleansing of mobile gaming apps on Google Play and by the top of the year, there have been but 300,000 gaming apps on the platform. Mobile gaming began trending upwards again within the first few months of 2019.

Since then, the amount has been steadily increasing, resulting in the primary quarter of 2021. quite 50,000 gaming apps were added therein quarter, making it the most important increase ever during a single quarter.

Now, gaming apps are approaching the five hundred ,000 mark again, making them the only hottest sort of app on the Google Play store. Gaming apps structure quite 13% of the apps on the platform, while education apps are available second, with just over 9%.

Mobile gaming has cemented itself as an enormous part of the mobile app space and therefore the Google Play store seems to be leading the charge. Though mobile gaming is clearly still evolving, it’s pretty obvious that it’s here to remain.

Alphabet’s market capitalisation of over $1.5 trillion makes it one among the foremost valuable publicly traded companies within the world, trailing only Apple, Microsoft and Amazon.

Created in 2015, Alphabet is actually a company for Google, which generates nearly all of its revenue and profit. Google has always portrayed itself as a tech company and has invested in many far-reaching areas of technology — like internet search, mobile phones, AI , self-driving cars and health technology. Its conference for software developers, Google I/O, which kicks off Tuesday, typically intersperses deep tech talk with far-reaching visions of the longer term .

But Google’s main business is online advertising. In 2020, Alphabet generated almost $183 billion in revenue. Of that, $147 billion — over 80% — came from Google’s ads business, consistent with the company’s 2020 annual report.

Google has been the market leader in online advertising for overflow a decade and is predicted to command nearly a 29% share of digital ad spending globally in 2021, consistent with eMarketer. Number-two Facebook is predicted to capture but 24%, while Alibaba is projected to be a foreign third, with but 9%.

Over the years, Google has built and purchased a slew of ad tech tools that enable content publishers to form money through advertising and let ad buyers hunt down the sorts of people they might wish to get ahead of on Google Search, YouTube, Maps and on other websites across the web . While Search and other properties structure the majority of Google’s ad revenues, its YouTube advertising business, which saw a near 50% year-over-year jump within the half-moon , is increasingly grabbing ad dollars faraway from traditional linear television.

Here are the main pieces of Google’s advertising business and the way they create money.

That “search and other” figure includes revenue generated on Google’s search properties, along side ads on other Google-owned properties like Gmail, Maps and therefore the Google Play app store.

Advertisers using Google products can bid on search keywords specific words and phrases that lead their ads to point out up to relevant users in search results.

Any advertiser can choose between different bidding strategies. If they need to get traffic to their site, as an example , they could prefer to do “cost-per-click” bidding, where they pay when someone clicks on their ads. they will choose a maximum amount they need to buy that click, and every time a billboard is eligible to seem for an enquiry , an auction will determine whether the ad shows up, and during which position.

“Usually, the more competitive and costlier an industry is, the costlier the bid goes to be,” said Joe Balestrino, a digital marketing specialist.

“For example, if you’re an attorney and you affect crane accidents … you’re watching about many dollars in lawsuit, you’re likely to pay a few hundred dollars for that click. [Whereas] if you’re running a house-cleaning business, you’re probably paying $7 a click because your average sale is probably 50 bucks. So counting on how competitive the niche and the way much money a business owner stands to form , the more costly those keywords are,” he said.

Google also lets advertisers target a location, language and audience like people that have an interest in buying finance-related products or services or who are renters vs. homeowners.

The company primarily shows ads on commercial searches, which suggests about 80% of searches still aren’t monetized through ads, consistent with estimates from Wedbush. As buying increasingly moves online, analysts expect ad budgets to continue shifting from areas like linear television and marketing into search.